Founding lenders each commit $1 million to be invested across 5 to 10 BuildForward projects of the lenders’ choice. Each project will be funded by multiple lenders, each contributing loan shares of $100,000 to $250,000 depending on the overall size of the project.

Loan terms are customized for each borrower based on a 1 to 2 year construction loan, and can be rolled into a long-term loan at the end of the construction.

Rates will be negotiated by BuildForward based on the credit quality of the borrower. Rates normally range from 5 to 8%.

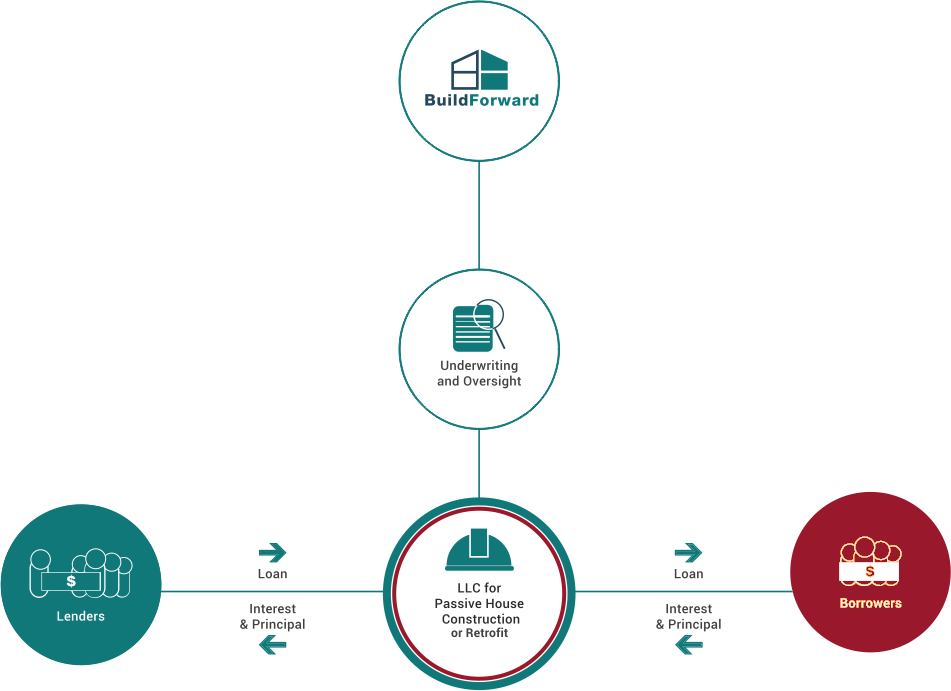

BuildForward loans are structured as construction loans, wherein the real estate acts as collateral. Our underwriting and credit models are based on standard bank models, overlaid with our extensive investment management expertise. Every transaction requires approval by the credit committee and senior principals at BuildForward Capital.

BuildForward are secured with a first lien or second lien on the property. Additionally refinancing existing mortgages is available for construction projects. LTV and LTC analyses assure that there will be substantial equity underlying a combined loan. We require loans to have at maximum a 70% combined LTV. Once construction is complete these loans are normally rolled into standard bank mortgages with approximately 80% LTV.

BuildForward lenders have the opportunity to invest across multiple construction loans according to lender preferences and in order to diversify their risk commitment. Each loan is structured into a separate LLC, ultimately providing a direct connection between investors and projects.

Lenders choose to invest on a case by case basis. The initial indication of interest is not a final commitment to lend to any particular projects. Investors are provided with a choice of construction project and decide in which ones to invest.

BuildForward projects have an 18-24 month term, a comparatively shorter period than most construction loans. While there is potential for short term maturity extensions, most loans are rolled into standard mortgages at maturity. Mortgages typically offer borrowers higher LTVs and lower rates upon completion of construction.

Availability of standard construction loans from banks is severely limited today, due to the relatively high cost of origination, underwriting and servicing. These costs bring loan profitability below target banks ROEs, especially in the under $5 million segment. BuildForward’s role as a credit advisory firm rather than a balance sheet lender removes these ROE constraints. This allows us to link lenders directly to borrowers and create loan products of the size necessary for the energy efficiency market.

Low loan expenses: The peer-to-peer nature of the structure allows us to control the cost of sourcing and servicing each loan. The price matching process between the borrower and the lender optimizes the resulting interest rate, potentially creating a rate for a borrower lower than a comparable one from a bank.

Simplified process: As professionals from the alternative investments sector, our expertise enables us to analyze credits and underwrite loans with a turnaround that is faster and more streamlined than established banks. The BuildForward lending network serves the needs of borrowers interested in creating deeply energy efficient buildings, either in renovation or new construction. Loans are provided through project specific LLCs and will have requirements similar to standard bank construction loans. However, unlike banks we offer fixed-rate loans which facilitate the entire borrowing process. In addition to meeting credit requirements, our premise is that the loan be used to fund a deep energy efficiency program.